CA Course After 12th: Eligibility, Duration, Fees & Career Paths

SKIP TO WHAT YOU'RE LOOKING FOR

Pursuing a CA degree after your 12th grade offers doors to a world of options in accounting, auditing, taxation, and financial management thanks to its demanding curriculum and renowned universities.

CA course after 12th offers a curriculum that integrates theoretical knowledge with practical training. Students learn about accounting, auditing, taxation, financial management, and other related subjects – this helps them to gain expertise in various finance-related fields.

Completing the CA course after the 12th grade can take around 4.5 to 5 years, depending on how soon the student can progress through the various stages.

CA Exam Overview

The CA exam refers to a set of examinations conducted by the Institute of Chartered Accountants of India (ICAI) as part of the Chartered Accountancy (CA) course.

The course is well-known worldwide and holds great significance in the fields of finance and business. It educates people with a thorough understanding of financial concepts, regulations, and procedures so they can handle challenging financial situations.

Throughout the course, students receive thorough instruction and practical experience. It helps in their development into professionals who exhibit morality and integrity in addition to being efficient with money.

What is a Chartered Accountant (CA)?

A professional accountant who has earned the Chartered Accountant credential from an approved professional accounting sector is known as a chartered accountant (CA). In many countries across the world, accounting professionals are awarded the internationally known CA qualification.

Chartered accountants (CAs) possess years of experience in a range of financial management competencies, including:

- Accounting

- Taxation

- Auditing

- Financial planning.

They advise people and companies on issues pertaining to financial management and are essential in guaranteeing the integrity and transparency of financial reporting.

CAs can find employment in a variety of settings, such as corporations, government agencies, non-profit organizations, and public accounting organizations.

CA Course Details After 12th in 2024

After completing the 12th grade, follow to this step-by-step guidance about CA Course details to seek a career as a CA:

CPT Path following Class 12:

- After passing the 12th grade exam, register with the Institute of Chartered Accountants of India (ICAI) to take the standard competence examination.

- There are four subjects on the test: quantitative analysis, law, accounting, and economics.

- The admission exam carries 200 marks, and passing requires a minimum score of 100 out of 200.

Register in the IPCC, or Integrated Professional Competence Course:

- Candidates who meet the requirements and have cleared the CPT and 12th grade exams can sign up for IPCC.

- Register nine months in advance of the examination starting day.

- There are seven subjects totalling 700 marks in the CA IPCC test.

- A minimum of 40 marks in each subject and an overall score of at least 50 percent are needed to pass the exam.

- Exam topics have been divided into two groups: Advanced Accountancy, IT and Strategic Management, Audit, and Law, Taxation, Costing, and Finance Management are tested in the second group, while Accounts, Law, and Taxation exams are included in the first.

- A candidate who receives 60 or more points is not required to reappear for that specific paper in the future.

Internship or articleship:

The next stage after passing the CA IPCC test is to register for an articleship, which is a three-year training programme or internship. The training is being conducted by a certified chartered accountant.

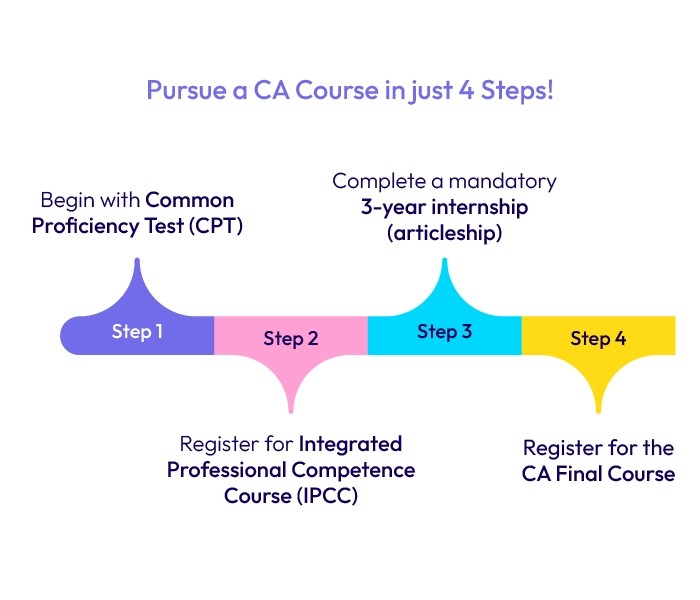

How Do You Pursue a CA Course After Class 12th in 2024?

Below are the prerequisites and specifics of the CA course that you should be aware of following the 12th grade. Examine them closely to find out how you might pursue your ideal career.

After completing high school, you can take the CA course in the following ways:

Step 1: After passing Class 10, begin the CA course via the CPT method.

Step 2: Register for the course on integrated professional competence (IPCC).

Step 3: Pass the Final CA exam and finish a three-year articleship, which doubles as a required internship.

Step 4: Register for the CA Final Course.

CA Final Course Enrollment:

- The final six months of the three-year internship programme are dedicated to the CA Final Course.

- The candidate can register as an ICAI member and formally become a chartered accountant after passing all of the tests.

Fees for CA Courses:

- After 12th grade, the whole CA course costs between INR 50,000 and 80,000.

- Included in this are costs for journaling, entrance exams, orientation courses, registration, and other related expenditures.

CA Course Duration:

- After 12th grade, the CA programme requires 4.5–5 years to finish at the very least.

- After successfully completing the CPT/CA foundation course for nine months, the candidate is qualified for the IPCC.

- The candidate is entitled to start the internship after passing Group I of the IPCC.

- Depending on their preference, students can either study the intermediate course after graduation or simply register for the CA course following their 12th-grade graduation.

Related Blog: Study Charted Accountant in the UK

Eligibility to Become CA Course after 12th in 2024

- Following your graduation from high school, you will need to fulfill the following prerequisites in order to pursue a career as a chartered accountant:

- You have to have received your high school diploma from a reputable board.

- You need to have passed the commerce stream exam in your 12th-grade year.

- Additionally, certain boards could take students from other streams.

- It is necessary for you to register with the Institute of Chartered Accountants of India (ICAI) upon clearing the 10th or its equivalent.

CA Syllabus & Subjects 2024

The ICAI's recommended syllabus serves as the foundation for the CA test. Candidates can easily study for the accountancy exam and increase their chances of doing well if they have a thorough understanding of the ICAI CA syllabus.

The CA Foundation course is bifurcated into four different parts. Take a look at the topics covered in each four sections of the papers:

Module 1 & 2

|

Module |

Table |

|

Module 1 |

|

|

Module 2 |

|

CA Foundation Paper No. 2: Business Laws, Business Reports, and Business Correspondence

|

Paper |

Chapters |

|

Paper 1 Sec A: Business Laws |

|

|

Paper 2 Sec B: Business Correspondence and Reporting |

|

CA Foundation Paper-3: Statistics, Logic, and Business Mathematics

|

Parts |

Chapters |

|

Part A: Business Mathematics |

|

|

Part B: Logical Reasoning |

|

|

Part-C: Statistics |

|

CA Foundation Paper-4: Business Economics and Business and Commercial Knowledge Business Economics and Commercial and Business Knowledge

|

Part |

Chapters |

|

Part I: Business Economics |

|

|

Part 2: Business and Commercial Knowledge |

|

Career in CA after 12th in 2024

Chartered accountants can find employment in a wide range of industries, including financial institutions, legal and auditing organizations, capital market services, public and private limited corporations, and more.

They can be employed by big consulting firms like Deloitte, KPMG, and Barclays, or by publicly traded chartered accounting businesses. Professionals in the public sector can get employment with organizations like LIC, NRHM, GAIL, Metro Rail Corporation LTD, and others.

|

Job Profile |

Average Salary Per Annum (INR) |

|

Chartered Accountants |

11,50,000 |

|

Auditor |

6,00,000 |

|

Financial Managers |

15,42,996 |

|

Chief Financial Officers |

52,00,000 |

|

GST Experts |

3,00,000 |

|

Tax Manager |

14,80,000 |

|

Consultant |

13,49,822 |

|

Tax Advisor |

4,40,040 |

|

Management Accountant |

12,40,000 |

|

Business Analyst |

11,99,597 |

Takeaway

Join AECC to start your path to a fulfilling career in chartered accounting (CA). After completing your 12th grade education, take a look at our specially created courses that will help you navigate the CA process.

Our team will help you choose the best course of action and offer complete support along the way. Don't pass up this chance to set yourself up for success in the finance industry. With AECC, start down the path to your CA dream right now.

Payal Chandra

Expertise in training & development in overseas education

Payal Chandra, with a rich background in training and development within the international education sector, is a significant contributor to shaping the academic and professional futures of students aspiring to study abroad. Her career spans roles that have put her at the forefront of student engagement and development, particularly in the context of overseas education.

Categories